)

)

The crypto trends to watch out for in 2022

Though we don’t have a crystal ball, we’ve pulled together 10 trends for crypto in 2022 that are worth considering.

- Article Quick Links:

- #1 Further Nation State adoption of Bitcoin

- #2 CBCDs will gather momentum

- #3 Bitcoin to be tested as an Inflation Hedge

- #4 Get ready for regulation

- #5 More innovation around DAOs

- #6 Interoperability becomes a reality

- #7 The debate around Web3.0 will continue

- #8 ETH moves toward PoS

- #9 Watch the Ads For Super Bowl LVI

- #10 NFT Mania may cool

- PS Don’t mention the B word

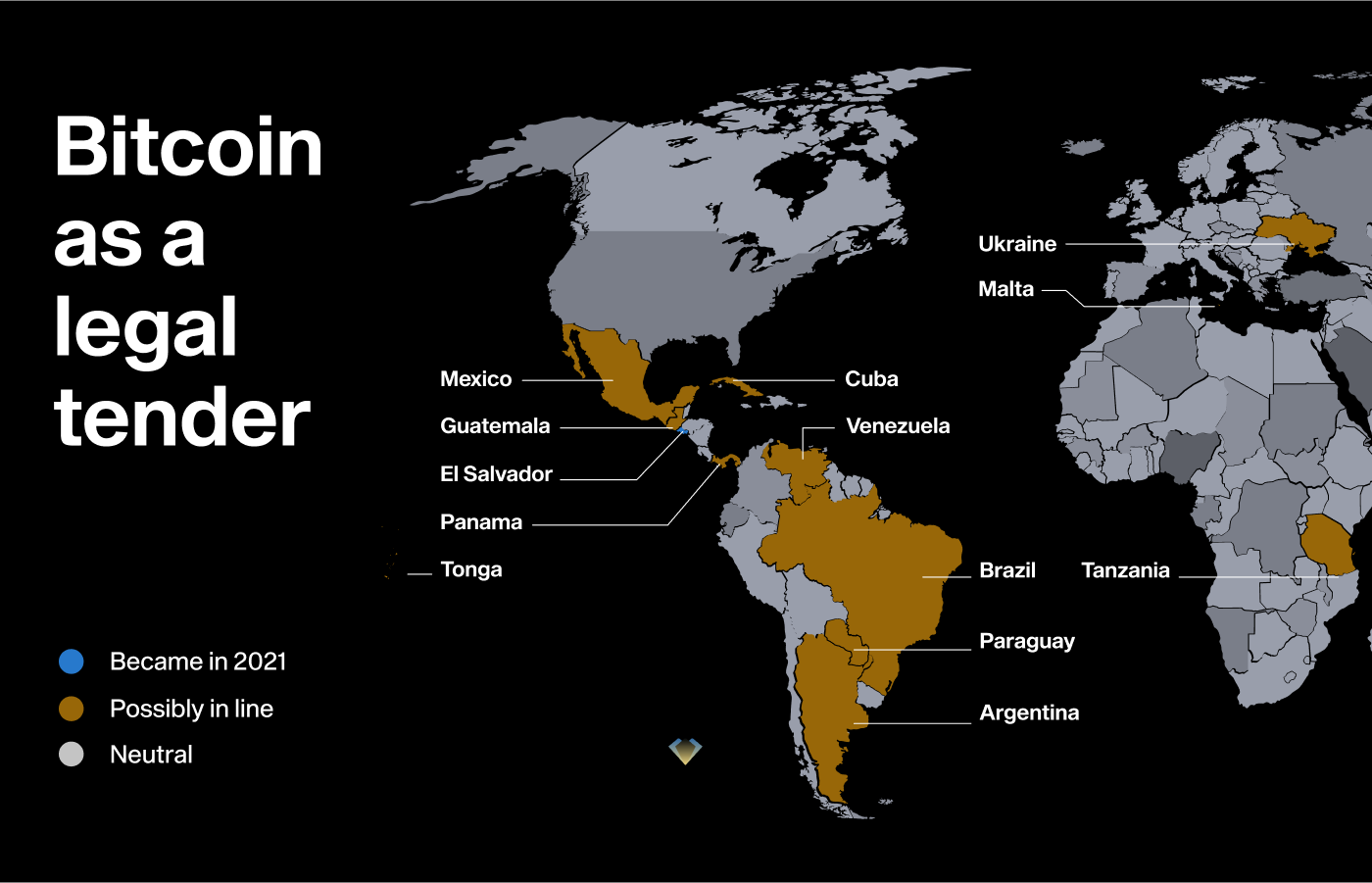

#1 Further Nation State adoption of Bitcoin

One of the biggest stories of 2021 was El Salvador becoming the first nation state to make Bitcoin legal tender. We’re only six months down the road from that decision, so it’s far too soon to understand the impact, but President Bukele certainly seems to have swallowed a full prescription of orange pills.

El Salvador has added 1.371 Bitcoin to its treasury and plans to issue so-called Volcano Bonds, raising $1billion dollars at a coupon rate of 6.5% to buy more bitcoin, and build a Bitcoin City powered leveraging the Central American nations’ geo-thermal energy.

Over 2million users have downloaded the Chivo App, designed to onboard locals to the Lightning Network, but reports suggest progress has been slow. Chivo has been dogged by problems, with many cashing out the free $30 and little else.

We shouldn’t be surprised. El Salvador is the Canary in the coalmine for nation state Bitcoin adoption, so pay close attention to progress in LN usage volumes this year.

Vitalik Buterin called it reckless to try and onboard so many people with so little prior education, but Bukele predicts two more countries will follow suit in 2022, and he teased a big announcement coming at April’s Bitcoin2022 Conference in Miami.

[Source: https://twitter.com/nayibbukele/status/1477464599612076038]

Several countries have indicated an interest in following in El Salvador’s footsteps, including Panama, Mexico, Argentina and Tanzania.

If the second nation state domino in Bitcoin adoption does fall in 2022, it could have a more significant impact on price than the first.

[Bitcoin as a legal tender across the world. Sources: news.bitcoin.com — cityam.com — coinmarketcap.com — investmentweek.co.uk — cointelegraph.com]

#2 CBCDs will gather momentum

We highlighted the number of Central Banks experimenting with CDBCs in a separate article, and 2022 looks set to be the where that activity moves up a notch.

[Source: https://twitter.com/CoinDesk/status/1477970664472596483]

[Source: https://twitter.com/CoinDesk/status/1477970664472596483]

Jamaica completed an eight month CBDC trial on December 31st, 2021, with plans to roll-out a pilot in the 1st quarter of 2022. It may only be a small Caribbean nation, but the experiment will be closely watched.

China is also expected to advance its own eCNY CBDC trial in 2022, starting the year with a pilot version of a digital Yuan wallet. There are unconfirmed reports that the Beijing Winter Olympics, starting on February the 4th, will be used for a broader roll-out by venues and athletes.

[Source: https://twitter.com/BlockBeatsChina/status/1478213772288622595]

CBDCs becoming a reality might be construed as a threat to Stablecoins, but given the national currencies will remain on the Fiat standard, it could actually drive more interest in the wider crypto ecosystem. Only time will tell.

[Definition of CBDCs. Source: investopedia.com]

[Definition of CBDCs. Source: investopedia.com]

#3 Bitcoin to be tested as an Inflation Hedge

Bitcoin’s unforgettable digital scarcity makes it an effective store of value, with comparisons to gold. This narrative suggests that like gold, Bitcoin should be an effective hedge against inflation. 2022 could be the year that gets fully tested and the consequences could be far reaching.

2021 saw official inflation figures in major Western economies hitting levels not seen since the 1970s; real inflation figures almost certainly paint an even worse picture.

[Comparison of the price of a cup of coffee in USD vs. Bitcoin between 2018 and 2022. Source: macrotrends.net]

Supply chain problems from the Covid Pandemic coupled with pent-up demand and huge spikes in energy prices, look set to continue in 2022, driving inflation higher.

This matters to Bitcoin for two reasons. Firstly, if it does what it says on the tin, investors should use it as a risk-off asset, hedging against the decreasing purchasing power of cash.

Secondly, higher inflation in America is pushing the Federal Reserve to taper the stimulus it has been pumping into the economy ever since the 2008 Financial Crisis.

Subscribe To The NGRAVE Blog

Get the latest insights on crypto, security, blockchain, and more.

By signing up, you agree to receive our marketing offers following our Privacy Policy. You can unsubscribe at any time.

Some analysts feel that Bitcoin — and the wider crypto economy in general — have been beneficiaries of this cheap money, and may suffer stress as it gets withdrawn.

How Bitcoin deals with these opposing forces could define a key stage in its evolution over the coming year, and we’ve seen an early sign of this when the Fed released notes from its December meeting on Jan 5th, and within 24hrs Bitcoin was down 7%.

#4 Get ready for regulation

Several US Senate Committee Hearings were held in 2021 discussing the threats and opportunities posed by crypto, while legislation was passed, in the form of Joe Biden’s trillion dollar Infrastructure Bill, which will have far-reaching implications for crypto.

Though not enforced until January 2024, crypto investors and brokers will be required to provide significantly more information when reporting taxes, and for transactions above a $10,000 threshold, but more regulation is expected in 2022.

[The EU is edging closer to a new legal framework for regulating crypto. Source: MiCA on europa.eu.]

Gary Gensler, the chair of the SEC, has been gearing up to tackle concerns over the ‘decentralization theater’ engaged in by DEFI. In other words, he doesn’t buy that DEFI is anywhere near as decentralised as its name suggests, and likely feels they are more like the services his department regulates.

A number of CEFI businesses — Celsius, BlockFi & Nexo — are already under investigation at the state level for promoting unlicensed banking products, while Coinbase was effectively warned off launching its own Lend service.

Related Articles

Those cases should conclude in 2022, and at least provide some clarity, but the threat to Stablecoin issuance, which is the liquidity lubricating the whole crypto ecosystem, is the most eagerly anticipated.

A report in November by three relevant US departments recommended regulatory oversight of Stablecoins that, in their currency opaque form, could effectively push them outside the US market.

Though acknowledging the potential benefits, the PWG (President’s Working Group on Financial Markets), along with the Federal Deposit Insurance Corporation (FDIC) and Office of Comptroller of Currency (OCC), recommended that

“To address these risks…..that Congress act promptly to enact legislation to ensure that payment stablecoins are subject to a federal prudential framework on a consistent and comprehensive basis.”

Buckle up. When the US legislates, many countries will follow suit.

2022 will see the European Union edge closer towards a new legal framework for regulating crypto — Markets in Crypto Assets (MiCA) — which is likely to place greater burdens on token-issuers and stablecoins.

Turkey fast-tracked crypto-specific legislation in late 2021 that should become law in early 2022. Increasing numbers of Turks are turning to crypto with the Lira seeing wild volatility, so the legislation is aimed at making exchanges more transparent and auditable, but there may also be changes to taxation.

India is set to push a much-awaited crypto bill through parliament this year, while additional crypto legislation is expected in South Korea — after elections — and in Japan.

#5 More innovation around DAOs

In 2021 a Decentralised Autonomous Organisation emerged raising $42million in an attempt to buy a copy of the US Constitution being auctioned by Sotheby’s. The Constitution DAO ultimately failed, but the speed at which they morphed from meme, to genuine contenders to own a crucial piece of American history, didn’t go unnoticed.

DAOs offer a new way for disparate digital communities to self-organise around a common financial aim. This is how Jonah Ehrlich, founder of ConstitutionDAO. Put it:

“The most fun description I’ve heard is that a DAO is a group chat with a bank account.”

The question is, which ‘group chat’ will pop-up next and what mission they will decide to pursue. Some of the more obvious applications could be fans buying their local soccer team or favourite artists’ back catalogue. There are already DAOs for buying a golf course and resurrecting Blockbuster.

[Definition of Decentralized Autonomous Organizations (DAOs). Source: cointelegraph.com.]

Almost anything is possible, and given the blockchains on which DAOs are supported are permissionless, that could include some fairly controversial ideas. What about financing a fringe political or environmental movement?

Though DAOs are theoretically headless, they don’t emerge spontaneously. The existence of founders means that the existing friction within hierarchical communities will still apply, especially when money can be made.

The idealistically named PEOPLE token, which gives owners a vote in the governance of the Constitution DAO, is still seeing millions of dollars of trading months even after the hammer fell on the auction. 2022 could well see a slew of disruptive DAOs.

#6 Interoperability becomes a reality

2021 saw the rapid growth of new layer 1 blockchains to rival Bitcoin and Ethereum, such as Solana, Avalanche and Terra. But these new chains, and the dApps they support, will exist as islands without a way to bridge and connect them.

This challenge can be summarised as the need for ‘interoperability’ and 2022 could see significant improvement in that area.

[Interoperability between blockchains will be an important challenge in 2022.]

Polkadot, the brainchild of Ethereum co-founder, Gavind Wood, finally went live with its solution to the problem at the end of 2021, with the successful bidders of the so-called parachains busy building on the layer zero foundation Polkadot provides.

Cosmos is also building towards a multi-chain system, with significant milestones planned for 2022.

As DEFI continues its unstoppable growth, bridging solutions will become even more important in order to move value between services supported by different chains, as will oracles — the data carriers.

The fate of web3.0, one of the biggest trends expected in 2022, may depend on the ability of blockchains to talk to each other, and 2022 will likely see a lot of innovation focused on that problem.

#7 The debate around Web3.0 will continue

A quick glance at Google Trends shows that the term ‘web3.0’ was trending as the year ended. Much of that traffic would likely have been people wondering what the hell web3.0 means?

[Interest in Web3.0 in 2021. Source: Google Trends.]

Jack Dorsey, Twitter’s ex-CEO, even got into a heated debate with venture capitalists, a16z, as to what the term implies.

[Source: https://twitter.com/jack/status/1473506824741601288]

Web3.0 is essentially about using concepts like decentralisation and permissionless/open source technology, to reverse the trend of internet users as products, and instead allow them to leverage and own the utility they contribute to services.

The issue that Dorsey has is that in his eyes, decentralisation cannot be VC funded, yet plenty of investor dollars are being funneled into web3.0 type projects under the themes of ‘play to earn’ and ‘metaverse’.

Those will likely continue to be trending themes in 2022, and let’s not forget that Facebook rebranded as Meta in 2021, and will be surely rolling out services this year to show everyone why.

#8 ETH moves toward PoS

One of the biggest arguments in crypto is between Bitcoin Maximalists, who believe it is the only true decentralised network and Proof of Work is why, and those that back the more pragmatic view of decentralisation, and greater network effect, offered by Ethereum.

Ethereum’s 2022 roadmap includes some key milestones that will have significant bearing on that debate as it continues to transition from Proof of Work to Proof of Stake.

[The upcoming Proof-of-Stake protocol in the Ethereum network could reduce a carbon footprint the size of Finland. Source: Global Carbon Project.]

The Beacon Chain introduced staking, but didn’t change how Ethereum fundamentally works. That all changes in 2022 when it merges with the mainnet, making the significant consensus change, reducing energy consumption by 99.95% and eliminating a carbon footprint the size of Finland.

The state of the merge: ConsenSys’ Update on ethereum’s merge to proof of stake

This will no doubt reignite the ESG debate around Bitcoin, painting Ethereum as the environmentally progressive blockchain.

The market will of course decide what is more important — decentralisation or scalability — but expect plenty of discussion around whether ETH might flip BTC in terms of market cap in 2022.

#9 Watch the Ads For Super Bowl LVI

According to the Wall St.Journal, a single 30 second ad for Super Bowl LVI will cost $6.5million, and among this year’s crop of advertisers with deep enough pockets, are two crypto businesses — Crypto.com and FTX.

Super Bowl ads could put these brands in front of 100milliion viewers during the game, but this is just part of a much wider marketing strategy that both businesses are pursuing through mainstream sports sponsorship.

[Crypto companies aim to chase late adopters via advertising spending. Source: Wall Street Journal.]

Crypto.com paid around $700million over 20years for the naming rights to the home of the LA Lakers and Kings, just one of a slew of deals across basketball, F1, UFC and Soccer.

FTX have put their name on the Miami Heat’s Stadium, signed a huge deal with MLB and enlisted NFL legend, Tom Brady, as an ambassador.

This trend looks set to accelerate in 2022 as crypto brands adopt traditional marketing tactics chasing the late adopters and beyond.

The big question is how this traditional approach to customer acquisition plays out, given the stark contrast to organic growth of the earliest crypto brands such as Bitcoin and Ethereum.

Crypto.com turned to Matt Damon to give their recent campaign star credential, but has been flamed across Twitter for a lack of humility.

Go back twenty years, to what was billed the Dot.com Super Bowl, to see how advertising at the NFL showcase doesn’t mean you’ve made it.

20% of the ads in 2000 were for rising star internet stocks but that didn’t save them from the bursting dot.com bubble, which tanked all their share prices, and by the end of the year many had already gone out of business.

No one can predict what 2022 might bring, but it is definitely worth watching whether these brute force marketing tactics pay off for crypto brands as it could signal a whole new phase of adoption.

#10 NFT Mania may cool

There’s a piece of wisdom in relation to trends. If you can see the bandwagon, it’s already too late. If applied to NFTs, the sound of the wheels might have been audible when Pepsi, Coca Cola, Adidas and Nike dropped their collections, but the wagon was in full view when Melania Trump — former First Lady of the United States — minted an NFT on Solana in December 2021, called ‘Melania’s Vision’.

[Source: https://twitter.com/MELANIATRUMP/status/1478399612063035393]

She followed up with her ‘Head of State Collection, 2022” a commemoration of Trump’s first state visit — to France — which includes a signed hat, signed watercolor and a digital artwork NFT with motion, signed by Melania Trump and artist Marc Antoine Coulon.

The collection will be auctioned on January 25th, 2022 with bids starting at $250,000. It would be generous to say the Twitter reaction to the announcement was ‘mixed’.

It is easy to see Melania Trump’s foray into NFTs as pure opportunism, especially when displaying a sudden awareness of crypto history, tweeting about the 13th anniversary of Bitcoin’s Genesis Block.

Stepping outside the claims of grifting, Melania Trump’s move into NFTs is emblematic of a crypto genre that has gone stratospheric in a very short time. The question for 2022 is whether it will now come back down to earth.

Data on transaction volume of gaming NFTs from dApp Radar and Ethereum-based NFT marketplaces both showed month-on-month declines from August to November, which corrected in December.

It would be a mistake to throw all NFTs into the same basket. Demand at the high end of the NFT art market remains strong, whether the same will be true across GameFi, or the wider marketplace, saturated with cartoon collections, remains to be seen.

The challenge for the wider NFT market over the next 12 months is whether the hype can be matched by utility.

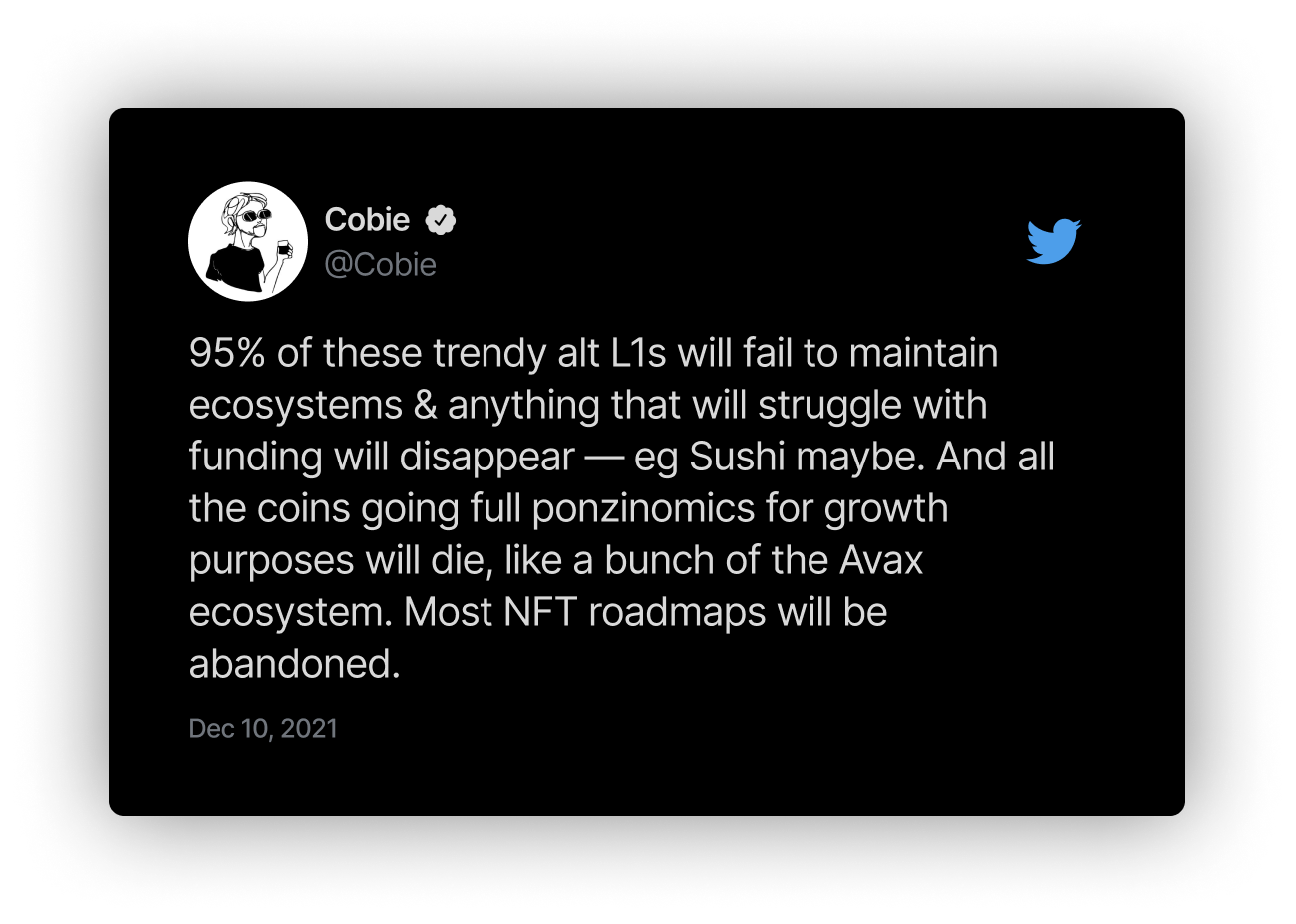

PS Don’t mention the B word

The crypto market saw a significant influx of new investors in 2021, and though those who invested at the top will have already felt discomfort of the declines from July’s ATHs, none will have experienced the pain and misery of a full-on Bear market.

As the saying goes, hope for the best, plan for the worst.

[Source: https://twitter.com/cobie/status/1469253171885318146]

Article Quick Links:

- #1 Further Nation State adoption of Bitcoin

- #2 CBCDs will gather momentum

- #3 Bitcoin to be tested as an Inflation Hedge

- #4 Get ready for regulation

- #5 More innovation around DAOs

- #6 Interoperability becomes a reality

- #7 The debate around Web3.0 will continue

- #8 ETH moves toward PoS

- #9 Watch the Ads For Super Bowl LVI

- #10 NFT Mania may cool

- PS Don’t mention the B word

)

Ruben is a repeat tech entrepreneur. His focus is on digital asset security and financial empowerment. He is co-founder and CEO of NGRAVE, the creator of “ZERO” - the world’s most secure hardware wallet for crypto storage. In 2021, he was selected for Belgium’s 40 under 40. Before that, he was a finalist in scale-ups.eu’s Disruptive Innovator of the Year 2020 Award, and nominated in Google/PWC/Trends’ Digital Pioneer 2020.

)

)